Identifying and evaluating the challenges of the central bank's comprehensive supervision using multi-criteria decision-making methods

Keywords:

supervision, central bank, multi-criteria decision making, banking systemAbstract

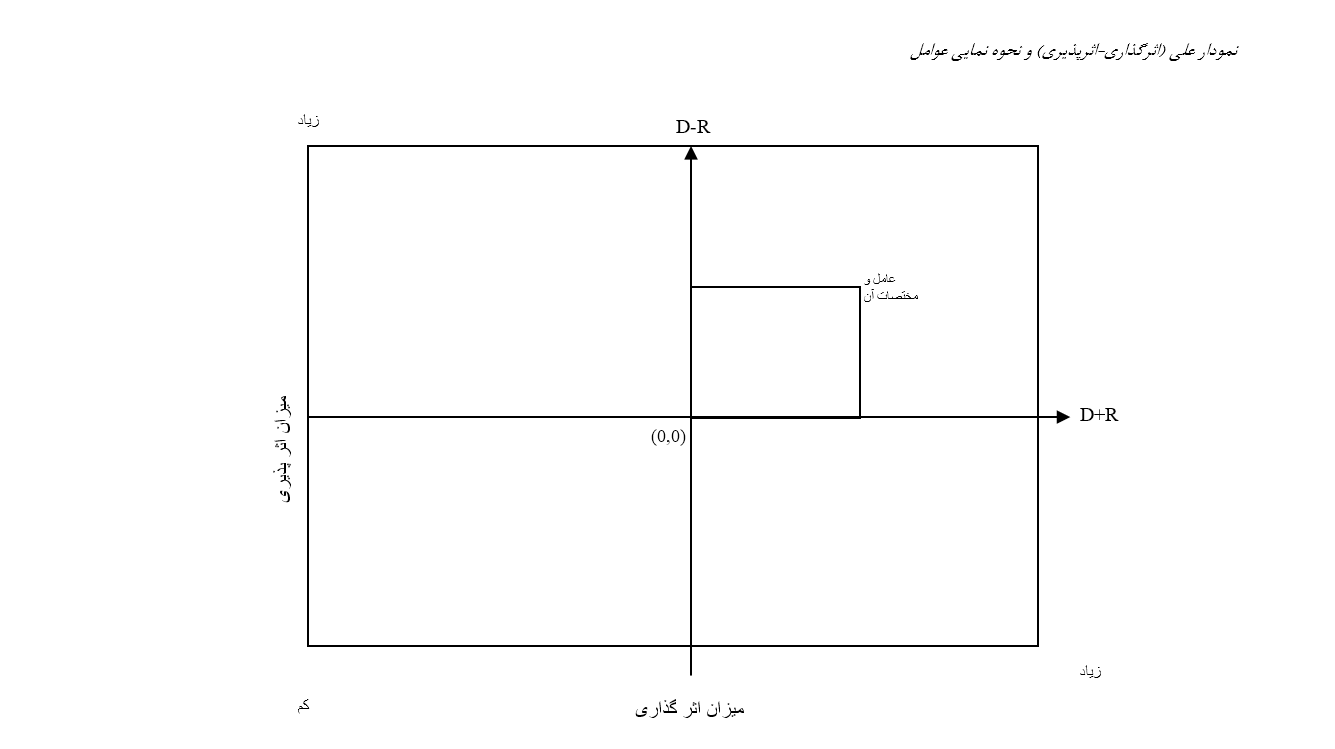

Identifying and evaluating the challenges of comprehensive supervision by the central bank refers to processes in which the country's central bank seeks to identify the problems and weaknesses present in the supervisory and financial system, as well as to assess the impact of these challenges on the performance and stability of the banking and financial system. Overall, identifying and assessing supervisory challenges is of significant importance for the central bank, as it aids in maintaining financial stability and preventing crises, ultimately safeguarding the interests of depositors and enhancing the credibility of the nation's financial system. The objective of this research is to identify and evaluate the challenges of comprehensive supervision by the central bank. In this study, 10 experts in the fields of banking and economics identified 15 key challenges and subsequently responded to a questionnaire designed for this purpose. The results of the analyses conducted using the DEMATEL method indicated that among the identified challenges, the lack of transparency in the central bank's operations and legal constraints for more precise supervision were recognized as the most influential challenges. These challenges play a crucial role in the quality of supervision and the effectiveness of the central bank, and addressing them could contribute significantly to improving the performance and credibility of the country's banking system. The findings of this research may provide valuable insights for policymakers in designing appropriate strategies to strengthen supervision within the financial system.

References

Abdullah Mamoon, Frank Kwabi, Ernest Ezeani & Wansu Hu.(2024). The impact of central bank independence and transparency on banks' non-performing loans and economic stability. Journal of Banking Regulation.

Agoba, A.M., J. Abor, K.A. Osei, and J. Sa-Aadu. (2017). Central bank independence and inflation in Africa: The role of financial system and institutional quality. Central Bank Review 17 (2017): 131–146.

Charles Goodhart.(1995). The central bank and the financial system. Springer.

Charilaos Mertzanis.(2024). Central bank policies and green bond issuance on a global scale. Energy Economics, Volume 133. https://doi.org/10.1016/j.eneco.2024.107541.

David Kuo Chuen Lee,Li Yan &Yu Wang.(2021). A global perspective on central bank digital currency.China Economic Journal, Volume 14, 2021 - Issue 1, Pages 52-66 Digital.Currency. https://doi.org/10.1080/17538963.2020.1870279.

Federico Maria Ferrara a, Siria Angino.(2021). Does clarity make central banks more engaging? Lessons from ECB communications. European Journal of Political Economy.Volume 74. https://doi.org/10.1016/j.ejpoleco.2021.102146

Haldane A.(2017). A little more conversation a little less action. Bank of England-Speech. https://www.bis.org/review/r170403e.pdf.

John Barrdear, Michael Kumhof.(2022). The macroeconomics of central bank digital currencies. Journal of Economic Dynamics and Control, Volume 142. https://doi.org/10.1016/j.jedc.2021.104148.

Kawai, Masahiro, Morgan, Peter J.(2012). Central banking for financial stability in Asia. ADBI Working Paper No. 37. https://hdl.handle.net/10419/101153.

Mehdi Memarpour, Ashkan Hafezalkotob, Mohammad Khalilzadeh, Abbas Saghaei, Roya Soltani.(2023). Modelling the effect of monetary policies of central bank on macroeco-nomic indicators in Iran using system dynamics and fuzzy multi-criteria decision-making techniques. Advances in Mathematical Finance and Applications, 10.22034/amfa.2022.1959354.1752.

Magdalena Radulescu, Aleksandra Fedajev ,Djordje Nikolic(2017). Ranking of EU national banking systems using multi-criteria analysis in the light of Brexit. Acta Oeconomica, Pages: 473–509. https://doi.org/10.1556/032.2017.67.4.1.

Nabilou, H. Testing the waters of the Rubicon: the European Central Bank and central bank digital currencies. J Bank Regul 21, 299–314 (2020). https://doi.org/10.1057/s41261-019-00112-1.

Nout Wellink(2023). Crises have shaped the European Central Bank. Journal of International Money and Finance, Volume 138. https://doi.org/10.1016/j.jimonfin.2023.102923.

Park, H., Kim, J.D. (2020).Transition towards green banking: role of financial regulators and financial institutions. AJSSR 5, 5. https://doi.org/10.1186/s41180-020-00034-3.

Silvia Angilella , Michalis Doumpos , Maria Rosaria Pappalardo , Constantin Zopounidis.(2024). Assessing the performance of banks through an improved sigma-mu multicriteria analysis approach. Omega, Volume 127. https://doi.org/10.1016/j.omega.2024.103099.

Sawa Omori.(2024). Do institutions matter? Political economy of the enhancement of banking supervision. Journal of Banking Regulation, Volume 25, pages 73–83.

Simon Dikau, Ulrich Volz(2020). Central bank mandates, sustainability objectives and the promotion of green finance. Ecological Economics Analysis, Volume 184. https://doi.org/10.1016/j.ecolecon.2021.107022.

Wolfram Berger , Friedrich Kißmer.(2014). Central bank independence and financial stability: A tale of perfect harmony?. European Journal of Political Economy,Volume 31, Pages 109-118. https://doi.org/10.1016/j.ejpoleco.2013.04.004.

William Oman, Mathilde Salin, Romain Svartzman.(2024). Three tales of central banking and financial supervision for the ecological transition. WIREs, Volume15, Issue3. https://doi.org/10.1002/wcc.876.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 The Decision Science and Intelligent Systems

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.