Estimating the Tax Capacity and Tax Effort of Different Countries in the World and Ranking Them Using Data Envelopment Analysis

Keywords:

tax economic capacity, tax effort, data envelopment analysis, hierarchical clustering, undesirable inputsAbstract

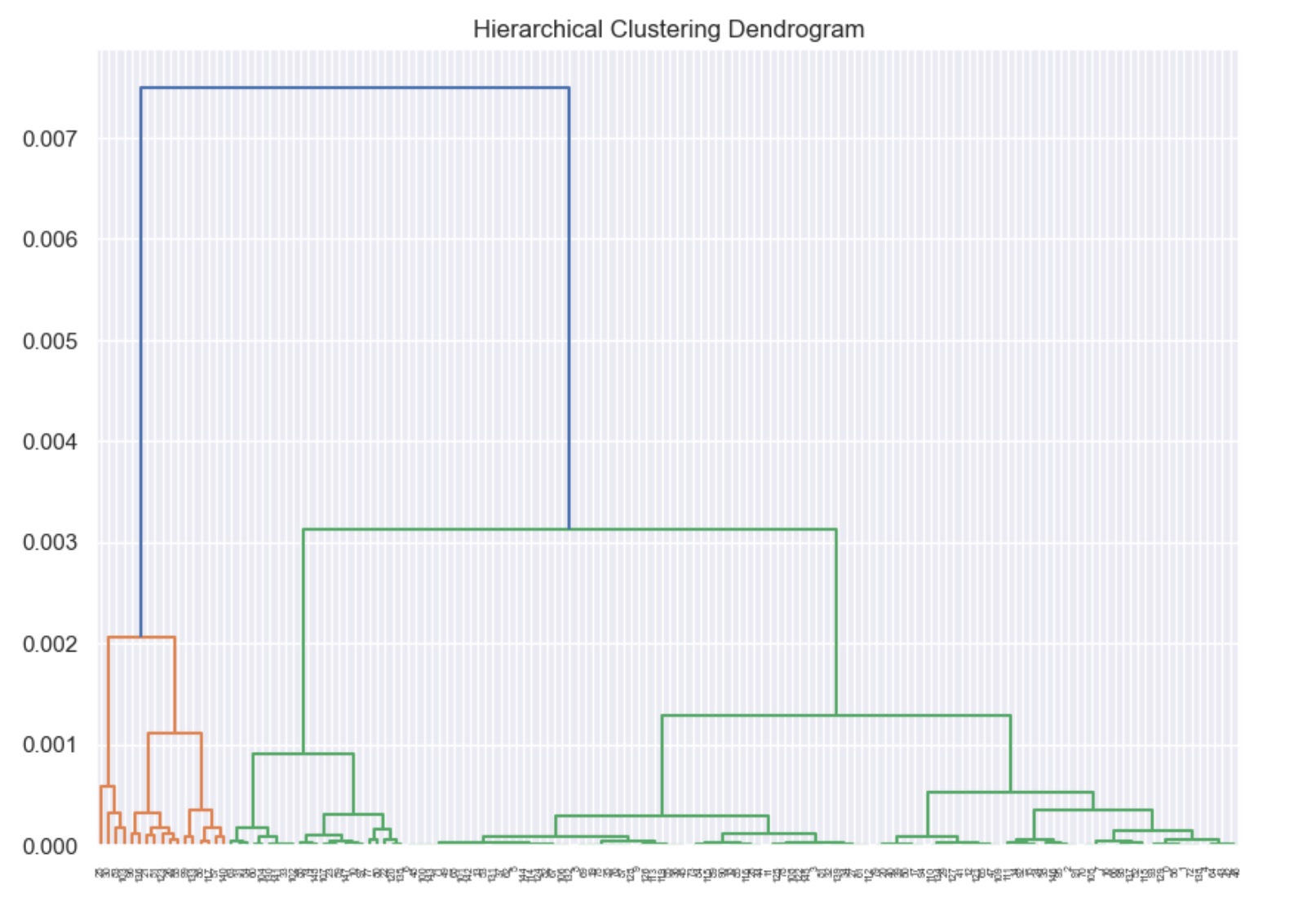

Thise study examines the tax capacity and tax effort of 149 countries, utilizing data envelopment analysis (DEA) combined with hierarchical clustering for differentiation.Tax capacity refers to the maximum potential tax revenue a country can achieve. While tax effort indicates the actual tax revenue collected relative to this potential. By categorizing countries into clusters, we uncover diverse levels of development and highlight strategies for improvement. Our methodology follows a four-step process involving correlation analysis, transformation of undesirable indicators, efficiency calculation, and rankings through the Anderson-Petersen method. Results reveal that economic indicators like GDP per capita influence tax capacities differently across nations. Some countries like Nepal and Mozambique outperform expectations in tax effort despite lower economic indicators, while others need significant policy reforms to optimize tax collection.