Evaluating The Efficiency of Iranian Listed Companies Using a Combined Method of Data Envelopment Analysis and Machine Learning

Keywords:

Iranian listed companies, performance evaluation, data envelopment analysis, machine learningAbstract

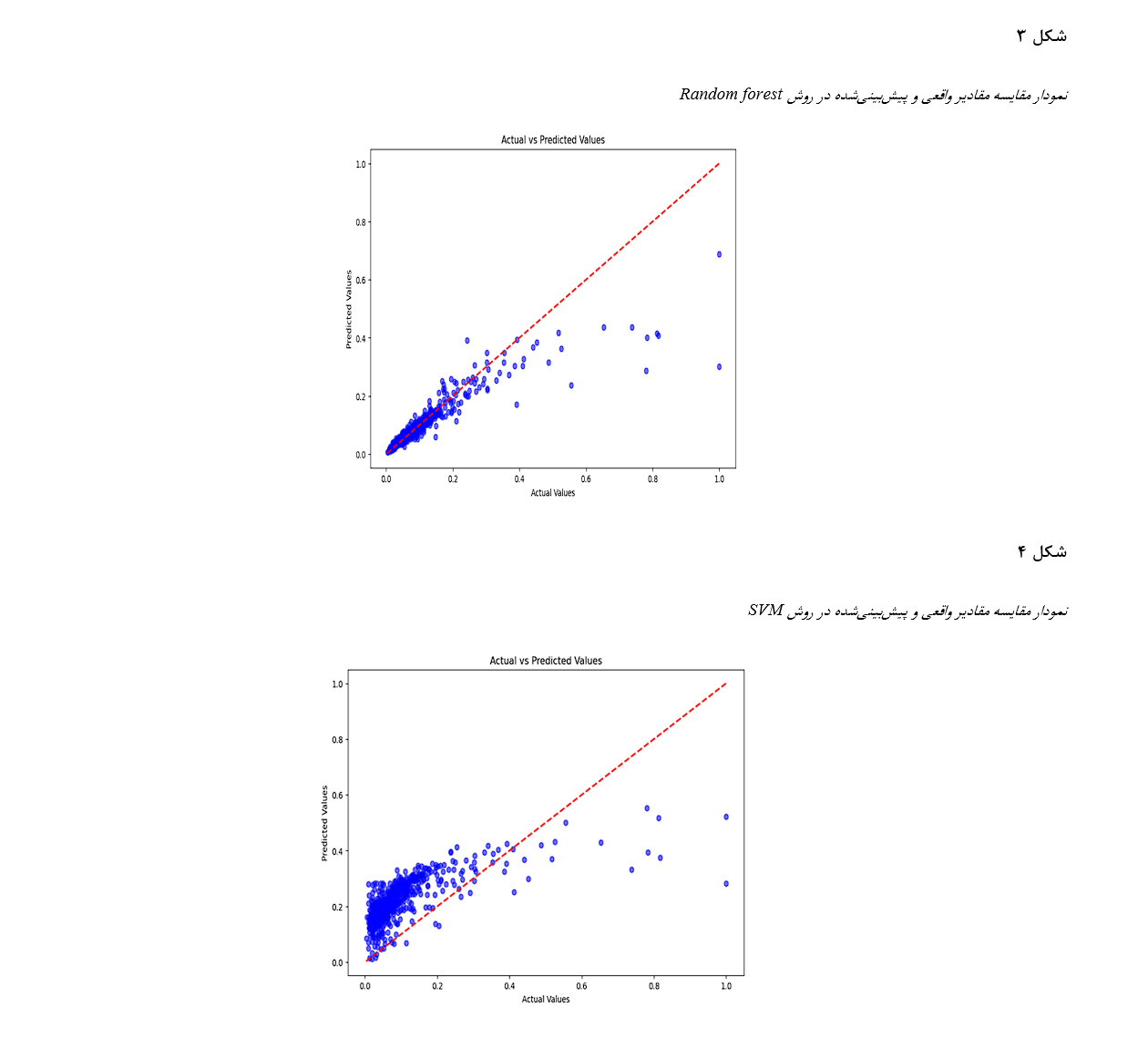

This paper examines the efficiency of Iranian listed companies using data envelopment analysis and machine learning algorithms. First, the efficiency scores of 130 listed companies in the period from 2007 to 2013 were calculated using data envelopment analysis. Input variables included total debt and RETRSIK and output variables included annual stock return and liquidity. Then, the machine learning algorithm was used to identify and evaluate critical variables in predicting company performance. The results showed that the XGBoost algorithm had superior prediction performance. This study shows that the combination of data envelopment analysis and machine learning methods can be an effective tool for analyzing and predicting the efficiency of listed companies and help investors and managers make decisions. This research emphasizes the role of modern data analysis methods in improving economic and financial decision-making.

References

Adabi, G. B., Moghaddam, S. R. H., Fouladi, A., & Samanta, N. (2017). An overview of corporate governance practices in Iran: a quantitative survey of listed companies in Tehran Stock Exchange. International Company and Commercial Law Review, 28(2), 33-48.

Ahsaan, S. U., Kaur, H., Mourya, A. K., & Naaz, S. (2022). A hybrid support vector machine algorithm for big data heterogeneity using machine learning. Symmetry, 14(11), 2344.

Alarussi, A. S. A. (2021). Financial ratios and efficiency in Malaysian listed companies. Asian Journal of Economics and Banking, 5(2), 116-135.

Ali, Z. A., Abduljabbar, Z. H., Taher, H. A., Sallow, A. B., & Almufti, S. M. (2023). Exploring the power of eXtreme gradient boosting algorithm in machine learning: A review. Academic Journal of Nawroz University, 12(2), 320-334.

Arsad, R., Isa, Z., Abidin, N., & Shaari, S. (2022). Stock Selection using the Data Envelopment Analysis Models and Dupont Analysis. International Journal of Academic Research in Business and Social Sciences, 12(8), 1770-1787.

Asselman, A., Khaldi, M., & Aammou, S. (2023). Enhancing the prediction of student performance based on the machine learning XGBoost algorithm. Interactive Learning Environments, 31(6), 3360-3379.

Avramov, D., Cheng, S., & Metzker, L. (2023). Machine learning vs. economic restrictions: Evidence from stock return predictability. Management Science, 69(5), 2587-2619.

Bansal, M., Goyal, A., & Choudhary, A. (2022). A comparative analysis of K-nearest neighbor, genetic, support vector machine, decision tree, and long short term memory algorithms in machine learning. Decision Analytics Journal, 3, 100071.

Bentéjac, C., Csörgő, A., & Martínez-Muñoz, G. (2021). A comparative analysis of gradient boosting algorithms. Artificial Intelligence Review, 54, 1937-1967.

Birjandi, A. K., Dehmolaee, S., Sheikh, R., & Sana, S. S. (2021). Analysis and classification of companies on tehran stock exchange with incomplete information. RAIRO-Operations Research, 55, S2709-S2726.

Bogdanova, B., & Stancheva-Todorova, E. (2021). ML-based predictive modelling of stock market returns. AIP Conference Proceedings,

Bouasabah, M. (2024). A Performance Analysis of Machine Learning Algorithms in Stock Market Prediction, Compared to Traditional Indicators. International Conference on Digital Age & Technological Advances for Sustainable Development,

Brunton, S. L., Noack, B. R., & Koumoutsakos, P. (2020). Machine learning for fluid mechanics. Annual review of fluid mechanics, 52(1), 477-508.

Burkart, N., & Huber, M. F. (2021). A survey on the explainability of supervised machine learning. Journal of Artificial Intelligence Research, 70, 245-317.

Chandra, M. A., & Bedi, S. (2021). Survey on SVM and their application in image classification. International Journal of Information Technology, 13(5), 1-11.

Charbuty, B., & Abdulazeez, A. (2021). Classification based on decision tree algorithm for machine learning. Journal of Applied Science and Technology Trends, 2(01), 20-28.

Costa, V. G., & Pedreira, C. E. (2023). Recent advances in decision trees: An updated survey. Artificial Intelligence Review, 56(5), 4765-4800.

Fallah, M., Hosseinzadeh Lotfi, F., & Hosseinzadeh, M. M. (2020). Discriminant analysis and data envelopment analysis with specific data and Its application for companies in the Iranian stock exchange. Iranian Journal of Operations Research, 11(1), 144-156.

Fotova Čiković, K., Martinčević, I., & Lozić, J. (2022). Application of data envelopment analysis (DEA) in the selection of sustainable suppliers: A review and bibliometric analysis. Sustainability, 14(11), 6672.

Hegde, J., & Rokseth, B. (2020). Applications of machine learning methods for engineering risk assessment–A review. Safety science, 122, 104492.

Hu, J., & Szymczak, S. (2023). A review on longitudinal data analysis with random forest. Briefings in Bioinformatics, 24(2), bbad002.

Jain, P. K., Pamula, R., & Srivastava, G. (2021). A systematic literature review on machine learning applications for consumer sentiment analysis using online reviews. Computer science review, 41, 100413.

Jiang, W. (2021). Applications of deep learning in stock market prediction: recent progress. Expert Systems with Applications, 184, 115537.

Keshavarz, H., & Rezaei, M. (2022). The Effect of Economic, Financial and Political Risk on the Risk and Return of Tehran Stock Exchange. Monetary & Financial Economics, 28(22), 127-152.

Khan, W., Ghazanfar, M. A., Azam, M. A., Karami, A., Alyoubi, K. H., & Alfakeeh, A. S. (2022). Stock market prediction using machine learning classifiers and social media, news. Journal of Ambient Intelligence and Humanized Computing, 1-24.

Krmac, E., & Mansouri Kaleibar, M. (2023). A comprehensive review of data envelopment analysis (DEA) methodology in port efficiency evaluation. Maritime Economics & Logistics, 25(4), 817-881.

Kumar, D., Sarangi, P. K., & Verma, R. (2022). A systematic review of stock market prediction using machine learning and statistical techniques. Materials Today: Proceedings, 49, 3187-3191.

Li, D., Hou, R., & Sun, Q. (2020). The business performance evaluation index method for the high-tech enterprises based on the DEA model. Journal of Intelligent & Fuzzy Systems, 38(6), 6853-6861.

Mehtab, S., & Sen, J. (2020). A time series analysis-based stock price prediction using machine learning and deep learning models. International Journal of Business Forecasting and Marketing Intelligence, 6(4), 272-335.

Narkunienė, J., & Ulbinaitė, A. (2018). Comparative analysis of company performance evaluation methods. Entrepreneurship and sustainability issues, 6(1), 125-138.

Nti, I. K., Adekoya, A. F., & Weyori, B. A. (2020). A systematic review of fundamental and technical analysis of stock market predictions. Artificial Intelligence Review, 53(4), 3007-3057.

Otchere, D. A., Ganat, T. O. A., Gholami, R., & Ridha, S. (2021). Application of supervised machine learning paradigms in the prediction of petroleum reservoir properties: Comparative analysis of ANN and SVM models. Journal of Petroleum Science and Engineering, 200, 108182.

Panwar, A., Olfati, M., Pant, M., & Snasel, V. (2022). A review on the 40 years of existence of data envelopment analysis models: historic development and current trends. Archives of Computational Methods in Engineering, 29(7), 5397-5426.

Rahimi, H., Minouei, M., & Fathi, M. (2022a). Financial distress of companies listed on the Tehran stock exchange using the dynamic worst practice frontier-based DEA model. Advances in mathematical finance and applications, 7(2), 507-525.

Rahimi, H., Minouei, M., & Fathi, M. R. (2022b). Predicting the Financial Distress of Companies Listed on the Tehran Stock Exchange Using DEA-DA Technique and Artificial Neural Network. Karafan Journal, 19(2), 593-621.

Ravanshad, M. R., Amiri, A., Salari, H., & Khodadadi, D. (2020). Application of the two-stage DEA model for evaluating the efficiency and investigating the relationship between managerial ability and firm performance. Advances in Mathematical Finance and Applications, 5(2), 229-245.

Rouf, N., Malik, M. B., Arif, T., Sharma, S., Singh, S., Aich, S., & Kim, H.-C. (2021). Stock market prediction using machine learning techniques: a decade survey on methodologies, recent developments, and future directions. Electronics, 10(21), 2717.

Ruiz, J. L., & Sirvent, I. (2022). Benchmarking within a DEA framework: setting the closest targets and identifying peer groups with the most similar performances. International Transactions in Operational Research, 29(1), 554-573.

Salman, H. A., Kalakech, A., & Steiti, A. (2024). Random Forest Algorithm Overview. Babylonian Journal of Machine Learning, 2024, 69-79.

Sha’Abani, M., Fuad, N., Jamal, N., & Ismail, M. (2020). kNN and SVM classification for EEG: a review. InECCE2019: Proceedings of the 5th International Conference on Electrical, Control & Computer Engineering, Kuantan, Pahang, Malaysia, 29th July 2019,

Shahin, M., Chen, F. F., Hosseinzadeh, A., & Zand, N. (2023). Using machine learning and deep learning algorithms for downtime minimization in manufacturing systems: An early failure detection diagnostic service. The International Journal of Advanced Manufacturing Technology, 128(9-10), 3857-3883.

Shahriari, M. (2023). Ranking and evaluation of financial efficiency of pharmaceutical companies accepted in Tehran Stock Exchange with the approach of data envelopment analysis and multi-criteria decision making. Advances in Mathematical Finance and Applications, 1(1), 219.

Talekar, B., & Agrawal, S. (2020). A detailed review on decision tree and random forest. Biosci. Biotechnol. Res. Commun, 13(14), 245-248.

Tangirala, S. (2020). Evaluating the impact of GINI index and information gain on classification using decision tree classifier algorithm. International Journal of Advanced Computer Science and Applications, 11(2), 612-619.

Vijh, M., Chandola, D., Tikkiwal, V. A., & Kumar, A. (2020). Stock closing price prediction using machine learning techniques. Procedia computer science, 167, 599-606.

Zaman, N., Ghazanfar, M. A., Anwar, M., Lee, S. W., Qazi, N., Karimi, A., & Javed, A. (2023). Stock market prediction based on machine learning and social sentiment analysis. Authorea Preprints.

Zhang, Z., Xiao, Y., Fu, Z., Zhong, K., & Niu, H. (2022). A study on early warnings of financial crisis of Chinese listed companies based on DEA–SVM model. Mathematics, 10(12), 2142.

Zhou, H., Zhang, J., Zhou, Y., Guo, X., & Ma, Y. (2021). A feature selection algorithm of decision tree based on feature weight. Expert Systems with Applications, 164, 113842.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 مجتبی غیاثی, امید ولیزاده, بهاره جوشنی, محسن لطفی (نویسنده)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.