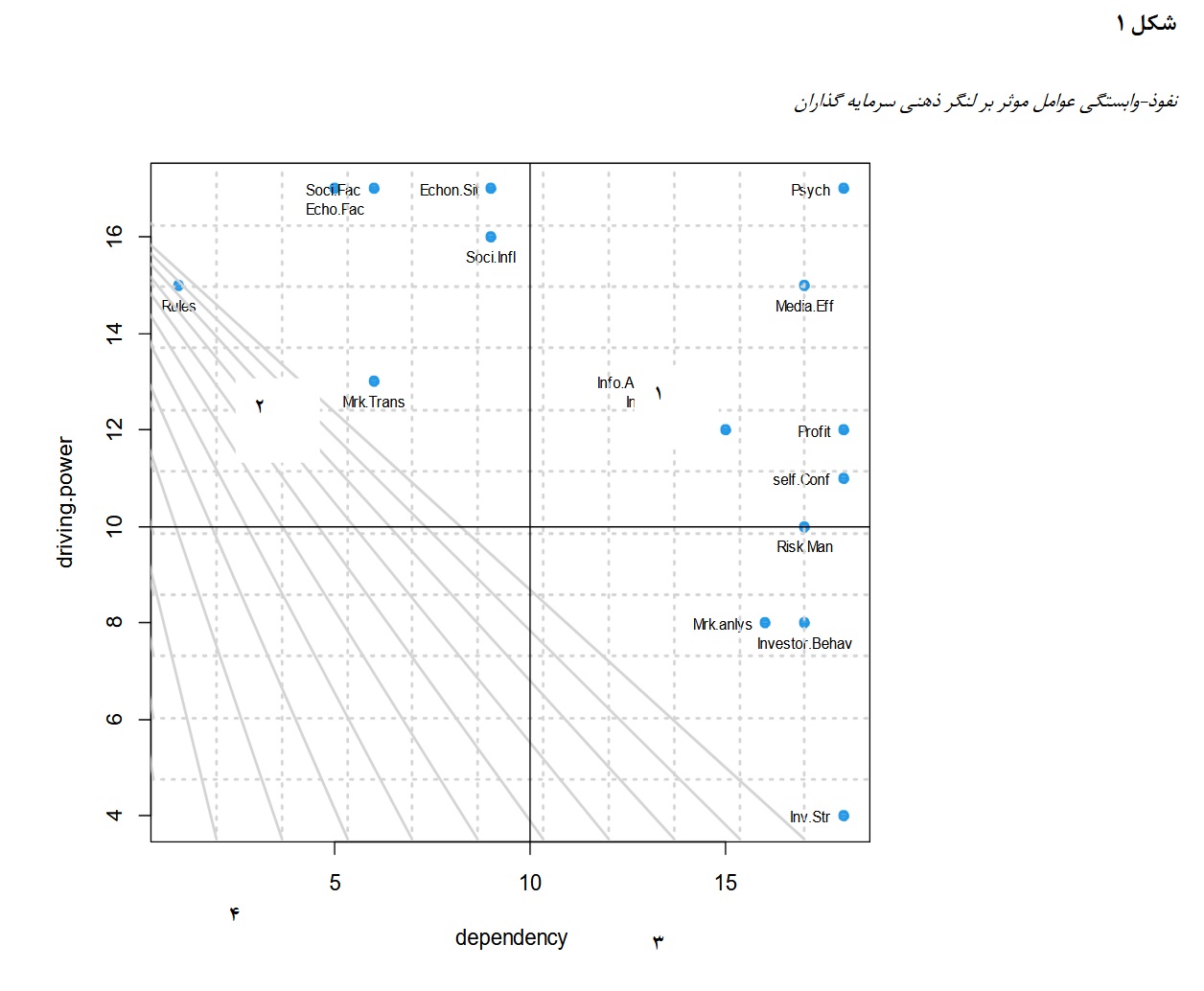

An interpretive structural model of factors affecting the phenomenon of investors' mental anchoring in the capital market

Keywords:

Behavioral biases, mental anchor, investment, interpretive structural modelAbstract

The purpose of this research was to design an interpretive structural model of the factors affecting the phenomenon of investors' mental anchoring in the capital market. This research is a survey in terms of its developmental purpose, a survey in terms of its data collection method, and a cross-sectional study in terms of its time. The model was presented based on a mixed method with a quantitative and qualitative approach. The statistical population included academic and capital market experts, of whom 15 were interviewed as a statistical sample until the theoretical saturation of the interview. In the qualitative stage, the results of the semi-structured interviews were analyzed using the content analysis method. The content analysis of the interviews with the experts led to the identification of 18 factors affecting the phenomenon of investors' mental anchoring, which were: initial experiences, information and analysis, the influence of the media, psychological factors, economic factors, social factors, market transparency, access to information, laws and regulations, investment strategies, risk management, market analysis, investment experience, economic situation, social influence, profitability, investor behavior trends, and self-confidence. The results of fitting the interpretive structural model of these factors showed that these factors can be categorized into 6 levels in terms of influence and impact. Psychological factors, investment strategies, profitability, and self-confidence have been identified as the most influential factors, while economic factors, social factors, laws and regulations, and economic situation have been identified as the most influential factors on investors' mental anchor.

References

Abbasi Ghamsari, Z. (2023). Investigating the impact of anchoring bias on investors’ decisions in the stock exchange with regard to the mediating role of financial knowledge and literacy. Qazvin Kar Institute of Higher Education, Accounting Department. [Unpublished manuscript].

Abideen, Z. U., Ahmed, Z., Qiu, H., & Zhao, Y. (2023). Do behavioral biases affect investors’ investment decision making? Evidence from the Pakistani equity market. Risks, 11(6), 109.

Ashfaq, M., Shafique, A., & Selezneva, V. (2024). Exploring the missing link: Financial literacy and Cognitive biases in Investment Decisions. Journal of Modelling in Management, 19(3), 871-898.

Choudhary, S., Yadav, M., & Srivastava, A. P. (2024). Cognitive biases among millennial indian investors: Do personality and demographic factors matter?. FIIB Business Review, 13(1), 106-117.

Dashtinejad, M., Imani Barandegh, M., Rostami, V., & Mohammadi, A. (2023). Evaluation of drivers of investors’ anchoring bias based on the constraints of derivative financial instruments. Accounting Knowledge Quarterly, 14(2), [pages unknown].

Dhingra, B., Yadav, M., Saini, M., & Mittal, R. (2024). A bibliometric visualization of behavioral biases in investment decision-making. Qualitative Research in Financial Markets, 16(3), 503-526.

Eslami Bidgoli, G., & Kordlouei, H. (2010). Behavioral finance: The transitional phase from standard finance to neurofinance. Journal of Financial Engineering and Portfolio Management, 1(1), 19–36.

Falahpour, S., & Abdollahi, G. (2011). Identification and weighting of behavioral biases of investors in Tehran Stock Exchange: A fuzzy AHP approach. Financial Research Journal, 13(3), [pages unknown].

Hanifehzadeh, L., Shaeri, S., Bozorg-Asl, M., & Rahimian, N. (2020). Financial reporting and the anchoring bias phenomenon among investors. Applied Research in Financial Reporting, 9(2), [pages unknown].

Jamali, H., & Bakhtiari, M. (2022). Evaluating behavioral biases influencing investors’ decision-making using the fuzzy analytic hierarchy process (FAHP). Quarterly Journal of Ethics and Behavior Studies in Accounting and Auditing, 1(3), [pages unknown].

Javdanzadeh, B., Hejazi, R., Salehi, A. K., & Basirat, M. (2021). Granger causality of the effect of financial reporting quality and information asymmetry on the level of anchoring bias in the Tehran Stock Exchange. Journal of Islamic Economics and Banking, 10(36), 177–202.

Karimi, K., & Rahnamaye Roudposhti, F. (2015). Behavioral biases and motivations of earnings management. Accounting and Auditing Management Knowledge, 4(41), 15–31.

Kratz Sofia &Gustav Wenning (2016). "Anchoring bias in Analysts’ EPS Estimates Evidence from the Swedish Stock Market". Department of Business Administration FEKN90, Business Administration Examensarbete På Civilekonomprogrammet Spring 2016 33(1), 42–57.

Rasouli, R., & Keshavarzi, Z. (2015). An analysis of behavioral factors influencing individual investor performance in the Tehran Stock Exchange. In National Conference on New Achievements in Accounting and Management, Tehran, Iran.

Robin, R. and Angelina, V. (2020). "Analysis of The Impact of Anchoring, Herding Bias, Overconfidence and Ethical Consideration Towards Investment Decision". JIMFE (Jurnal Ilmiah Manajemen Fakultas Ekonomi), 6(2), 253-264.

Sa'adatzadeh Hisar, B., Abdi, R., Mohammadzadeh Saltah, H., & Narimani, M. (2021). The role of cognitive bias in investor behavior (Teachers) in the stock market. Journal of School Psychology and Education, 10(2), [pages unknown].

Seifi, E. (2023). The effect of investor anchoring bias in the Tehran Stock Exchange on stock returns. In 1st International Conference on Management Empowerment, Industrial Engineering, Accounting, and Economics, Babol, Iran.

Tlili, F., Chaffai, M., & Medhioub, I. (2023). Investor behavior and psychological effects: herding and anchoring biases in the MENA region. China Finance Review International, 13(4), 667-681.

Wang, B. (2023). The Impact of Anchoring Bias on Financial Decision-Making: Exploring Cognitive Biases in Decision-Making Processes. Studies in Psychological Science, 1(2), 41-50.

Yasmin, F., & Ferdaous, J. (2023). Behavioral biases affecting investment decisions of capital market investors in Bangladesh: A behavioral finance approach. Investment Management and Financial Innovations, 20(2), 149-159.

Ziyari, M. (2023). Investigating the effect of behavioral biases on investor decisions in the Semnan Stock Exchange. In 16th National Conference on Economics, Management and Accounting, Shirvan, Iran.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 حمید رضا رضائی, علی ذبیحی, عباسعلی پور آقاجان (نویسنده)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.