Analysis of Efficiency and Productivity Growth in Iran’s Insurance Industry: A Data Envelopment Analysis Approach

Keywords:

Data Envelopment Analysis (DEA), Russell Efficiency Measure, Malmquist Productivity Index, Insurance IndustryAbstract

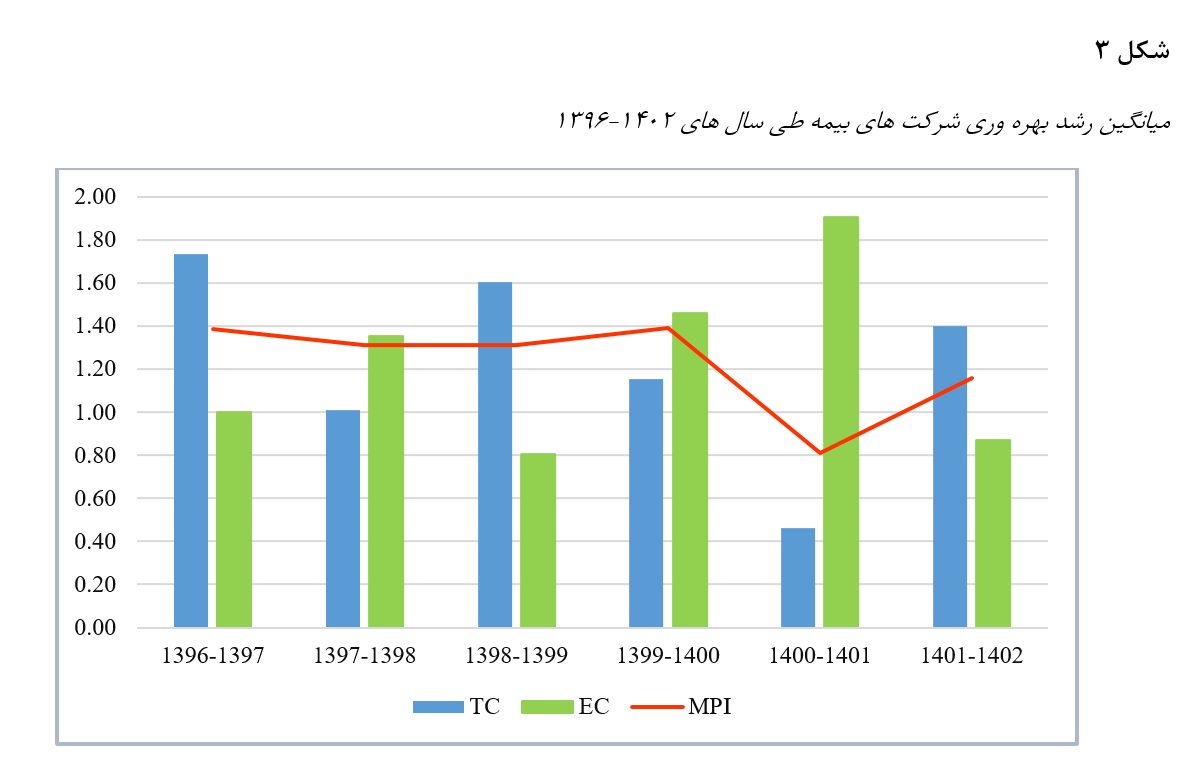

The insurance industry is one of the vital pillars of the financial system, playing an essential role in risk management, enhancing economic resilience, and facilitating investment. It has gained increasing significance in emerging and volatile economies such as Iran. The present study aims to evaluate the performance and analyze the productivity trends of Iranian insurance companies from 2017 to 2023 using the Data Envelopment Analysis (DEA) approach. Specifically, the non-radial Russell model and the Malmquist productivity index were applied. Additionally, the impact of contextual variables such as capital, number of branches, and company age on efficiency was examined through a linear regression model. For this purpose, the GAMS software was utilized. The findings indicate that during the studied period, Iran’s insurance industry experienced an unstable and predominantly declining trend in efficiency, particularly in critical years such as 2021–2022, when there was a sharp drop in technological and productivity indicators. However, in some years, there were signs of performance recovery and potential capacity for growth. The results also reveal that increasing capital alone did not guarantee improved efficiency, as traditional or inefficient structures hindered the optimal utilization of resources.

References

Abdollahi, A. (2025). Explaining a model for evaluating the performance of insurance companies using the data envelopment analysis model. Productivity Management Studies, 1(1), 57-72. doi: 10.22034/jmps.2025.141630.1004 (In Persian)

Alirezaee, M., Cheraghali, Z., & Rakhshan, F. (2016). Efficiency measurement of selected insurance companies using two-stage DEA models along with window analysis. Iranian Journal of Insurance Research, 5(4), 235-250. doi: 10.22056/ijir.2016.04.01 (In Persian)

Amirteimoori, A., Allahviranloo, T., & Arabmaldar, A. (2024). Scale elasticity and technical efficiency measures in two-stage network production processes: an application to the insurance sector. Financial Innovation, 10(1), 43.

Anandarao, S., Durai, S. R. S., & Goyari, P. (2019). Efficiency decomposition in two-stage data envelopment analysis: an application to life insurance companies in India. Journal of Quantitative Economics, 17(2), 271-285.

Babaei, S., Rostami Mal Khalifeh, M., & Heydari, M. (2024). Determinants of profitability in listed insurance companies on the Tehran Stock Exchange: A Data Envelopment Analysis approach. [Journal Name]. (In Persian)

Banker, R. D., Charnes, A., & Cooper, W. W. (1984). Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management science, 30(9), 1078-1092.

Banker, R. D., & Natarajan, R. (2008). Evaluating contextual variables affecting productivity using data envelopment analysis. Operations research, 56(1), 48-58.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European journal of operational research, 2(6), 429-444.

Cooper, A. C. W., & Charnes, W. (1962). Programming with linear fractional functionals. Naval Research logistics quarterly, 9(3), 181-186.

Cummins, J. D., Weiss, M. A., Xie, X., & Zi, H. (2010). Economies of scope in financial services: A DEA efficiency analysis of the US insurance industry. Journal of Banking & Finance, 34(7), 1525-1539.

Daneshvar, M., Azar, A., Adel, F., & Zali, M. (2007). Designing a performance evaluation model for insurance branches using DEA technique (Case study: Dana Insurance). Journal of Executive Management Research, 6.1(23), 37–62. (In Persian)

Doroudi, M., Abchar, M., Behjat, M., & Bigdeli, A. (2022). Productivity analysis using the Malmquist Index in private insurance companies of Zanjan Province. Financial Economics, 16(58), 109–127. (In Persian)

Đurić, Z., Jakšić, M., & Krstić, A. (2020). DEA window analysis of insurance sector efficiency in the Republic of Serbia. Economic Themes, 58(3), 291-310.

Esmaeili, M., & Shahbazi, K. (2018). Evaluating the performance trend of insurance companies' products using the data envelopment analysis method (case of study: fire, freight, aircraft, ship and engineering insurance fields). Iranian Journal of Insurance Research, 7(4), 230-243. doi: 10.22056/ijir.2018.04.01 (In Persian)

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society: Series A (General), 120(3), 253-281.

Färe, R., Grosskopf, S., & Lovell, C. K. (1985). The measurement of efficiency of production. Springer Science & Business Media, 6.

Gharakhani, D., Toloie Eshlaghy, A., Fathi Hafshejani, K., Kiani Mavi, R., & Hosseinzadeh Lotfi, F. (2018). Common weights in dynamic network DEA with goal programming approach for performance assessment of insurance companies in Iran. Management Research Review, 41(8), 920-938.

Ihara, M., & Laing, G. K. (2023). DEA Analysis of Performance Efficiency of the Non-Life Insurance Companies in Japan. The Journal of New Business Ideas & Trends, 21(2), 1-9.

Jafarzadeh, A., Safari, H., & Mehregan, M. (2014). Evaluating the efficiency and productivity of Iran Insurance Company branches using DEA and the Malmquist Index with weight restrictions. Future Management, 13(41), 131–144. (In Persian)

Javadipour, A., Safari, H., & Roshandel Arbatani, T. (2020). Efficiency evaluation and ranking of Iran Insurance Company agencies using AR-DEA with weight restrictions and Goal Programming (GP). (In Persian)

Kao, C., & Hwang, S. N. (2008). Efficiency decomposition in two-stage data envelopment analysis: An application to non-life insurance companies in Taiwan. European journal of operational research, 185(1), 418-429.

Kazemi, A., & Hosseinmirzaei Nabi, H. (2018). Performance evaluation of insurance company agencies using a combination of organizational excellence indicators and Data Envelopment Analysis. Research in Accounting and Economic Sciences, 3(2), 57–70. (In Persian)

Kumar, K. D., & Kumar, J. S. (2024). Efficiency assessment and trends in the insurance industry: A bibliometric analysis of DEA application. Insur. Mark. Co, 15, 83-98.

Lee, C. Y. (2014). The effects of firm specific factors and macroeconomics on profitability of property-liability insurance industry in Taiwan. Asian Economic and Financial Review, 4(5), 681-691.

Malmquist, S. (1953). Index numbers and indifference surfaces. Trabajos de estadística, 4(2), 209-242.

Nourani, M., Kweh, Q. L., Ting, I. W. K., Lu, W. M., & Strutt, A. (2022). Evaluating traditional, dynamic and network business models: an efficiency-based study of Chinese insurance companies. The Geneva Papers on Risk and Insurance-Issues and Practice, 47(4), 905-943.

Pargar, T., Shafiee, A., Afshar Kazemi, F., Fathi Hafshejani, Z., & Kiamarth, M. (2021). Developing a hybrid model of system dynamics and network Data Envelopment Analysis for performance prediction and evaluation of service supply chains: A case study of Social Security branches in Hormozgan. Financial Engineering and Securities Management, 11(45), 297–318. (In Persian)

Pastor, J. T., Ruiz, J. L., & Sirvent, I. (1999). An enhanced DEA Russell graph efficiency measure. European journal of operational research, 115(3), 596-607.

Pourkazemi, M. H., Samsami, H., & Ebrahimi Ghavamabadi, K. (n.d.). Measuring the efficiency and productivity of public and private insurance companies using Data Envelopment Analysis and the Malmquist Index. (In Persian)

Rejda, G. E. (2005). Principles of risk management and insurance. Pearson Education India.

Sabahi, A. and Falah, M. (2009). Data Envelopment Analysis (DEA) as a Method for Output Capacity Estimation the Case Study: Insurance Industry. Economics Research, 9(32), 205-238. (In Persian)

Sadeghian, T., Khademi Zare, H., & Hamzeh, A. (2024). Applying one-stage and two-stage Data Envelopment Analysis models for ranking insurance agencies by considering different segments of the supply chain. (In Persian)

Sanayei, A., Fallah, M., Hosseinzadeh Lotfi, F., & Mohebi Sobhani, M. (2021). Financial performance evaluation of Iranian insurance companies using the two-stage Data Envelopment Analysis technique. Financial Engineering and Securities Management, 12(48), 1–25. (In Persian)

Segovia-Gonzalez, M. M., Contreras, I., & Mar-Molinero, C. (2009). A DEA analysis of risk, cost, and revenues in insurance. Journal of the Operational Research Society, 60(11), 1483-1494.

Sinha, R. P. (2015). A dynamic DEA model for Indian life insurance companies. Global Business Review, 16(2), 258-269.

Tayebi, A., Lila, A., Cheikh, S., & Lutfi, B. (2024). Technical efficiency measurement in insurance companies by using the slacks-based measure (SBM-DEA) with undesirable outputs: analysis case study. Competitiveness Review: An International Business Journal, 34(1), 229-243.

Tone, K., & Sahoo, B. K. (2005). Evaluating cost efficiency and returns to scale in the Life Insurance Corporation of India using data envelopment analysis. Socio-Economic Planning Sciences, 39(4), 261-285.

Vintilă, A., Trucmel, I. M., & Roman, M. D. (2022). Measuring and analyzing the efficiency of firms in the insurance industry using DEA techniques. Journal of Social and Economic Statistics, 11(1-2), 59-83.

Wanke, P., & Barros, C. P. (2016). Efficiency drivers in Brazilian insurance: A two-stage DEA meta frontier-data mining approach. Economic Modelling, 53, 8-22.

Zhao, T., Pei, R., & Pan, J. (2021). The evolution and determinants of Chinese property insurance companies’ profitability: A DEA-based perspective. Journal of Management Science and Engineering, 6(4), 449-466.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 ماریه نعمتی زاده (نویسنده مسئول); مریم نعمتی زاده (نویسنده)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.