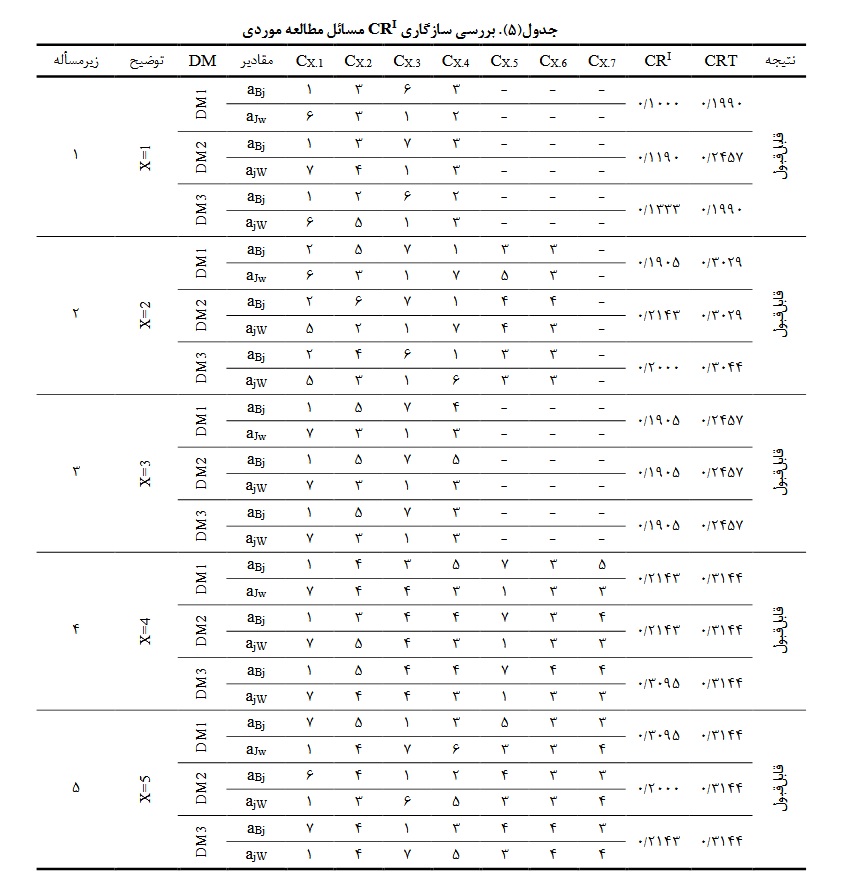

ارزیابی موانع تسهیم دانش در رفتار نوآورانه کارکنان با تأکید بر اخلاق و مسئولیت اجتماعی با ارائه روش بهترین-بدترین گروهی

سازمانها برای بهبود عملکرد و دستیابی به مزیت رقابتی پایدار، نیازمند کارکنانی خلاق و نوآور هستند. یکی از عوامل کلیدی در شکلگیری رفتار نوآورانه، تسهیم دانش میان کارکنان است. در این میان اخلاق کاری و مسئولیت اجتماعی دو عاملی هستند که میتوانند تأثیر مثبتی بر فرآیند تسهیم دانش داشته باشند. با این حال، در مسیر تسهیم دانش، موانعی وجود دارد که شدت و ماهیت تأثیر آنها در هر سازمان با توجه به ویژگیهای فرهنگی و ساختاری متفاوت است؛ از اینرو شناسایی و ارزیابی این موانع برای هر سازمان ضروری است. در این پژوهش، به منظور شناسایی و اولویتبندی موانع تسهیم دانش مؤثر بر رفتار نوآورانه کارکنان با تأکید بر اخلاق و مسئولیت اجتماعی، از روش بهترین–بدترین (BWM) به عنوان یکی از روشهای نوین و قدرتمند تصمیمگیری چندشاخصه (MADM) استفاده شده است. بدین منظور، ابتدا با مرور پیشینه پژوهش، تشکیل و برگزاری جلسات با تیم خبره 24 مانع تسهیم دانش با در نظر گرفتن 2 عامل یاد شده در یک نیروگاه حرارتی شناسایی گردید. سپس با استفاده از الگوریتم BWM گروهی ارائه شده در این پژوهش موانع مذکور ارزیابی، وزندهی و اولویتبندی شد. در نیروگاه مورد مطالعه به ترتیب موانع استراتژیک، تکنولوژی، فردی و فرهنگی به عنوان مهمترین موانع اصلی تسهیم دانش ارزیابی شد؛ همچنین به ترتیب22.93% و 33.68% از کل وزن موانع شناسایی شده، مرتبط با عاملهای اخلاق و مسئولیت اجتماعی اختصاص یافت. یافتهها حاکی از نقش پررنگ این 2 عامل در بهبود تسهیم دانش سازمانی است. بر این اساس، سازمانها برای موفقیت کسب و کار خود بایستی با تمرکز بر اخلاق کاری و مسئولیت اجتماعی، نسبت به شناسایی، ارزیابی و رفع مهمترین موانع تسهیم دانش اقدام کنند. افزون بر این، الگوریتم پیشنهادی میتواند به عنوان روشی معتبر، کارا و قابل اطمینان برای حل مسائل MADM مورد استفاده قرار گیرد.

مروری بر پژوهشهای انجام شده در ارزیابی عمکرد صندوقهای بازنشستگی با استفاده از تحلیل پوششی دادهها

در این پژوهش شرحی از روشهای مبتنی بر تحلیل پوششی دادهها از جمله روشهای CCR، BCC، SBM، تحلیل پوششی با دادههای ترکیبی (MV-DEA) و یک روش شبکهای دومرحلهای بیان میشود. همچنین انواع صندوقهای بازنشستگی از دیدگاههای مختلف از جمله صندوقهای بازنشستگی مزیت معین و مشارکت معین و ترکیبی، خصوصی و دولتی، باز و بسته، صندوقهای با مسئولیت اجتماعی (اخلاقی) و مسئولیتناپذیر، صندوقهای مستقل، نیمهمستقل و کامل معرفی میشود. با مرور پژوهشهای مختلف که در آن با استفاده از روشهای تحلیلی یاد شده، میزان کارایی هر یک از انواع صندوقها با سایر صندوقها مقایسه شده و عملکرد آنها مورد ارزیابی قرار گرفته، نتایج بدست آمده را مورد بررسی قرار میدهیم. این پژوهشها در کشورهای مختلف با ساختارهای اقتصادی متفاوت انجام شده است. نتایج بدست آمده در پژوهشها متنوع هستند. با مشاهده نتایج بهدستآمده درمییابیم که یکی از علتهای تنوع در نتیجهگیریها میتواند تفاوت در انتخاب دادههای ورودی و خروجی برای هر پژوهش باشد. همچنین ساختارهای فرهنگی و سیاسی متفاوت در مناطق مختلف نیز میتواند در نتایج بدست آمده مؤثر باشد.

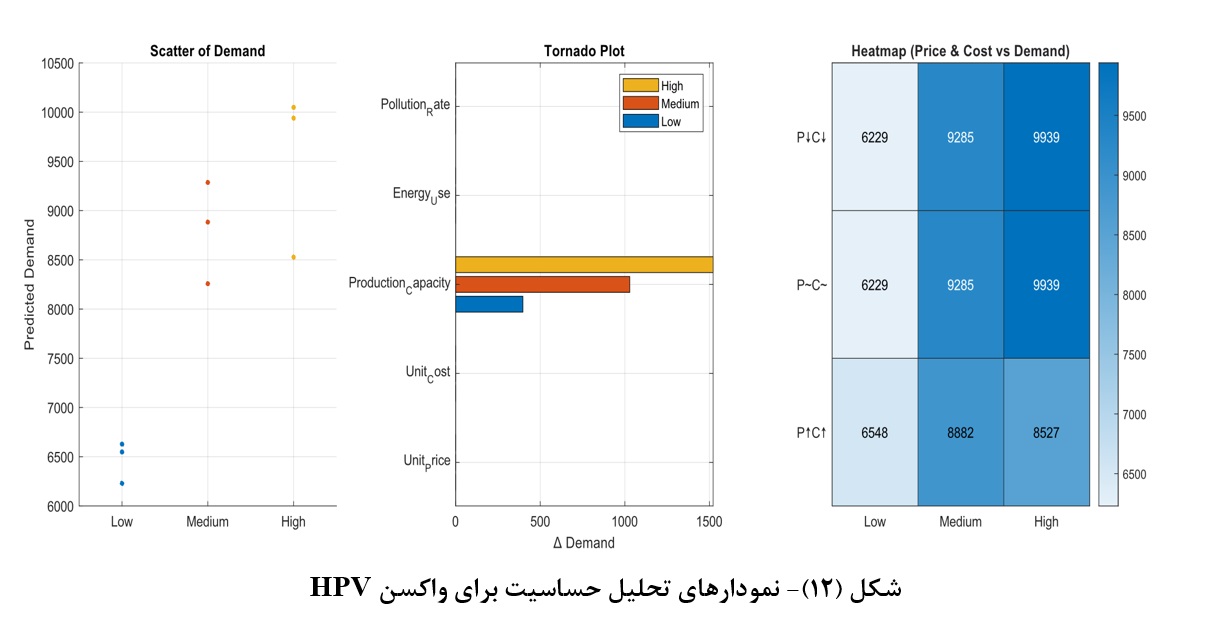

مدلسازی ریاضی برنامهریزی تولید دادهمحور با رویکرد چندهدفه و یادگیری ماشین در صنعت زیستدارو: ترکیب پیشبینی تقاضا و بهینهسازی پایدار

صنعت زیستدارو بهعنوان یکی از مهمترین بخشهای نوین دارویی، با چالشهای متعددی همچون نوسانات تقاضا، محدودیت منابع، فرآیندهای تولید پیچیده و الزامات زیستمحیطی روبهرو است. در چنین فضایی، رویکردهای دادهمحور و هوشمحور میتوانند نقشی کلیدی در ارتقای دقت تصمیمگیری، پایداری و سودآوری ایفا کنند. پژوهش حاضر با هدف توسعه یک چارچوب جامع برای برنامهریزی تولید پایدار، به ترکیب پیشبینی تقاضا با مدلسازی ریاضی چندهدفه پرداخته است. در گام نخست، دادههای واقعی مربوط به ۹ داروی منتخب طی ۳۶ ماه گردآوری شد و با استفاده از شبکه عصبی مصنوعی (ANN) و حافظه بلندمدت کوتاهمدت (LSTM) الگوهای تقاضا پیشبینی گردید. نتایج نشان داد مدل ANN با خطای RMSE برابر با ۸۶۸ توانست روندهای تقاضا را با دقت متوسط بازسازی کند، در حالیکه مدل LSTM توانست میانگین تقاضا را با خطایی کمتر از یک درصد در سطح دارو–سناریو تخمین بزند. در مرحله دوم، یک مدل ریاضی چندمحصولی و چندهدفه طراحی گردید که اهداف اقتصادی (بیشینهسازی سود و کاهش هزینهها) و زیستمحیطی (کاهش آلایندگی و ضایعات) را بهصورت همزمان در نظر گرفت. برای حل مدل، از الگوریتمهای ژنتیک (GA) و ازدحام ذرات (PSO) به همراه روش اپسیلون–محدودیت برای استخراج جبهه پارتو استفاده شد. یافتهها نشان داد GA در همگرایی سریعتر و PSO در جستجوی گستردهتر فضای جواب برتری نسبی دارند. همچنین تحلیل حساسیت چندمتغیره آشکار ساخت که ظرفیت تولید، هزینه مواد اولیه و نرخ آلایندگی بیشترین تأثیر را بر نتایج دارند. این تحقیق با پر کردن شکاف میان پیشبینی تقاضا و بهینهسازی تولید، چارچوبی عملی برای تصمیمسازی هوشمند در صنعت زیستدارو ایران ارائه میدهد و میتواند به افزایش تابآوری زنجیره تأمین، کاهش هزینهها و تحقق اهداف توسعه پایدار کمک نماید.

طراحی سیستم خودارزیابی بر اساس خطبه متقین و بررسی ارتباط بین بخشهای مختلف خطبه

این مقاله به معرفی و طراحی یک سیستم خودارزیابی محرمانه بر اساس خطبه همام میپردازد که هدف آن سنجش میزان تطابق افراد با ویژگیهای متقین ذکر شده در این خطبه است. سیستم مذکور از یک پرسشنامه جامع بهره میبرد که شامل جملاتی است که بر ویژگیهای اخلاقی، روحی و رفتاری متمرکز میباشد و به کاربران اجازه میدهد تا خود را بر اساس معیارهای ایمانی و دینی ارزیابی کنند. کاربران امتیازات خود را بر اساس مقیاس 1 (هیچوقت) تا 5 (همیشه) به جملههای مرتبط با رفتارهای نظیر صداقت، تواضع، پرهیز از اسراف، و عبادت شبانه اختصاص میدهند. روششناسی سیستم شامل سه مرحله اصلی است. مرحله اول جمعآوری دادهها و ارزیابی میباشد. پرسشنامهای متشکل از عبارات مشخص، نظیر پرهیز از افراط و نیکی در سخن گفتن، توسعه یافته و افراد پاسخهای خود را به صورت کمی ارائه میدهند. امتیازات افراد با جمعبندی نمرات سوالات محاسبه میشود. مرحله دوم تحلیل نتایج است که در آن نمرات کلی هر فرد با حداکثر نمره ممکن (200) مقایسه شده و درصد تطابق کاربر با معیارهای خطبه محاسبه میشود. نتایج به صورت یک عدد طبیعی بین 0 تا 100 به کاربر ارائه میشود و کمترین نمرات در رفتارها و ویژگیهایی که نیاز به بهبود دارند به همراه احادیثی از منابع مختلف برای راهنمایی و تأمل بیشتر ارائه میگردد. مرحله سوم ارائه پیشنهادات بهبود میباشد. در صورت وجود نمرات پایین، پیشنهاداتی برای بهبود یا تأمل در صفات مذکور به کاربر داده میشود. این فرآیند امکان تقویت افتخارات اخلاقی و معنوی کاربران را فراهم میآورد. در پایان نیز به کمک جمع آوری پاسخ برای پرسشنامه و محاسبه ضریب همبستگی، بیشترین ارتباط بین پرسشهای مربوط به عبادت و پرسشهای مربوط به پرهیزکاری پیدا شد. این پروژه با هدف تشویق افراد به بهبود صفات معنوی و ارائه روشهای عملی برای ارتقاء شخصیتی تدوین شده است و میتواند به عنوان یک ابزار مفید برای جامعه به کار گرفته شود.

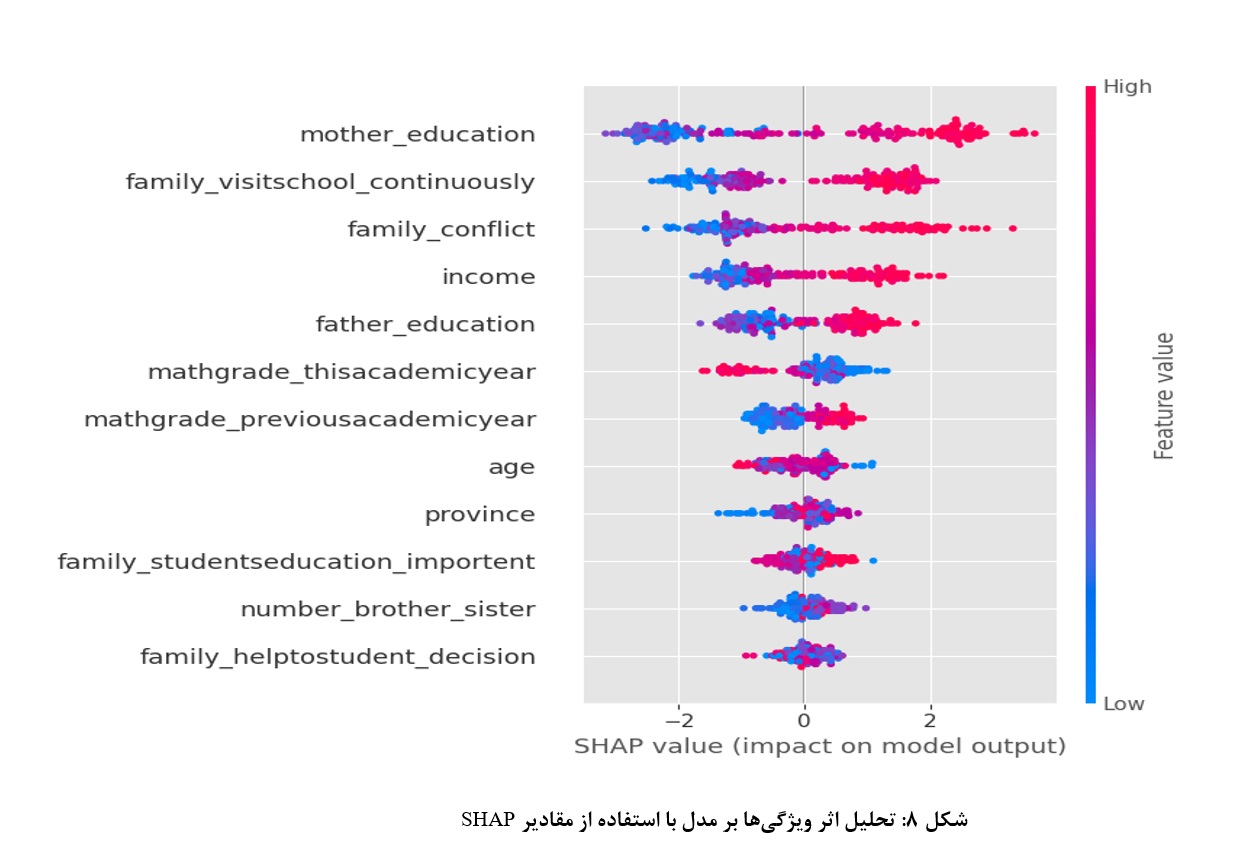

ارائه مدل هوشمند برای پیشبینی افت تحصیلی دانشآموزان با تأکید بر ویژگیهای خانوادگی: مطالعه موردی استان البرز

نظام آموزش و پرورش بهعنوان یکی از بنیانهای اصلی توسعه انسانی، نقشی کلیدی در ارتقاء فردی و اجتماعی ایفا میکند. افت تحصیلی دانشآموزان یکی از چالشهای جدی در این حوزه است که پیامدهای بلندمدت فردی و اجتماعی به همراه دارد. اگرچه مطالعات متعددی در سطح جهانی انجام شدهاند، پژوهشهای بومی در این زمینه هنوز محدود هستند؛ ازاینرو، انجام مطالعهای موردی در استان البرز میتواند به پر کردن این شکاف پژوهشی کمک کند. این پژوهش با هدف تحلیل و مدلسازی افت تحصیلی دانشآموزان بر اساس شاخصهای خانوادگی، بهصورت مطالعه موردی در استان البرز انجام شده است. دادههای تحقیق از مدارس دوره ابتدایی و متوسطه این استان گردآوری شده و شامل متغیرهایی همچون سطح تحصیلات والدین، میزان درآمد خانوار، نوع شغل والدین و ساختار خانواده بوده است. در راستای طراحی مدل پیشبینی افت تحصیلی، چهار الگوریتم یادگیری ماشین شامل رگرسیون لجستیک، ماشین بردار پشتیبان (SVM) با کرنل RBF، جنگل تصادفی و XGBoost بهکار گرفته شدند. نتایج نشان داد که در میان مدلهای استفادهشده، الگوریتم جنگل تصادفی بهترین عملکرد را داشته و با دقت ۹۸٪ توانست روابط پیچیده میان متغیرها را شناسایی کند. برای تحلیل روابط میان متغیرهای خانوادگی و افت تحصیلی، ابتدا از ضریب همبستگی اسپیرمن جهت بررسی ارتباطات آماری استفاده شد. سپس برای تبیین تصمیمات مدلهای یادگیری ماشین و شفافسازی نقش هر متغیر، از تحلیل SHAP بهره گرفته شد. بر اساس یافتهها، تحصیلات مادر، درآمد خانوار و تحصیلات پدر از مهمترین عوامل در بروز افت تحصیلی بودند. یافتههای این مطالعه میتواند در طراحی سیاستهای پیشگیرانه آموزشی و شناسایی بهموقع دانشآموزان پرریسک بسیار مؤثر واقع شود.

Exploring the Potential of ChatGPT in Human Resource Management: Opportunities, Challenges, and Strategic Insights

The merger of ChatGPT and human resources management (HRMs) is transforming the way firms manage their workforces. This white paper addresses the primary benefits and obstacles of applying the ChatGPT in human resource management, providing a complete analysis of its effectiveness, integrity, and impact on decision-making. ChatGPT enhance HR operations by automating repetitive tasks, decreasing biases in hiring and performance review, and enabling individual employee development programs. It also allows data-driven decision-making through predictive analytics and delivers significant insights into employee performance and engagement. However, successful deployment of a ChatGPT involves seamless interaction with existing systems and constant learning and modification to meet privacy and security concerns. Ethical considerations, such as transparency and justice, are vital to creating confidence and guaranteeing the responsible use of AI. Based on real-world applications and first-time user experiences, this paper gives strategic advice for HR professionals and businesses to employ ChatGPT successfully and build a more efficient, inclusive, and data-driven HR environment.

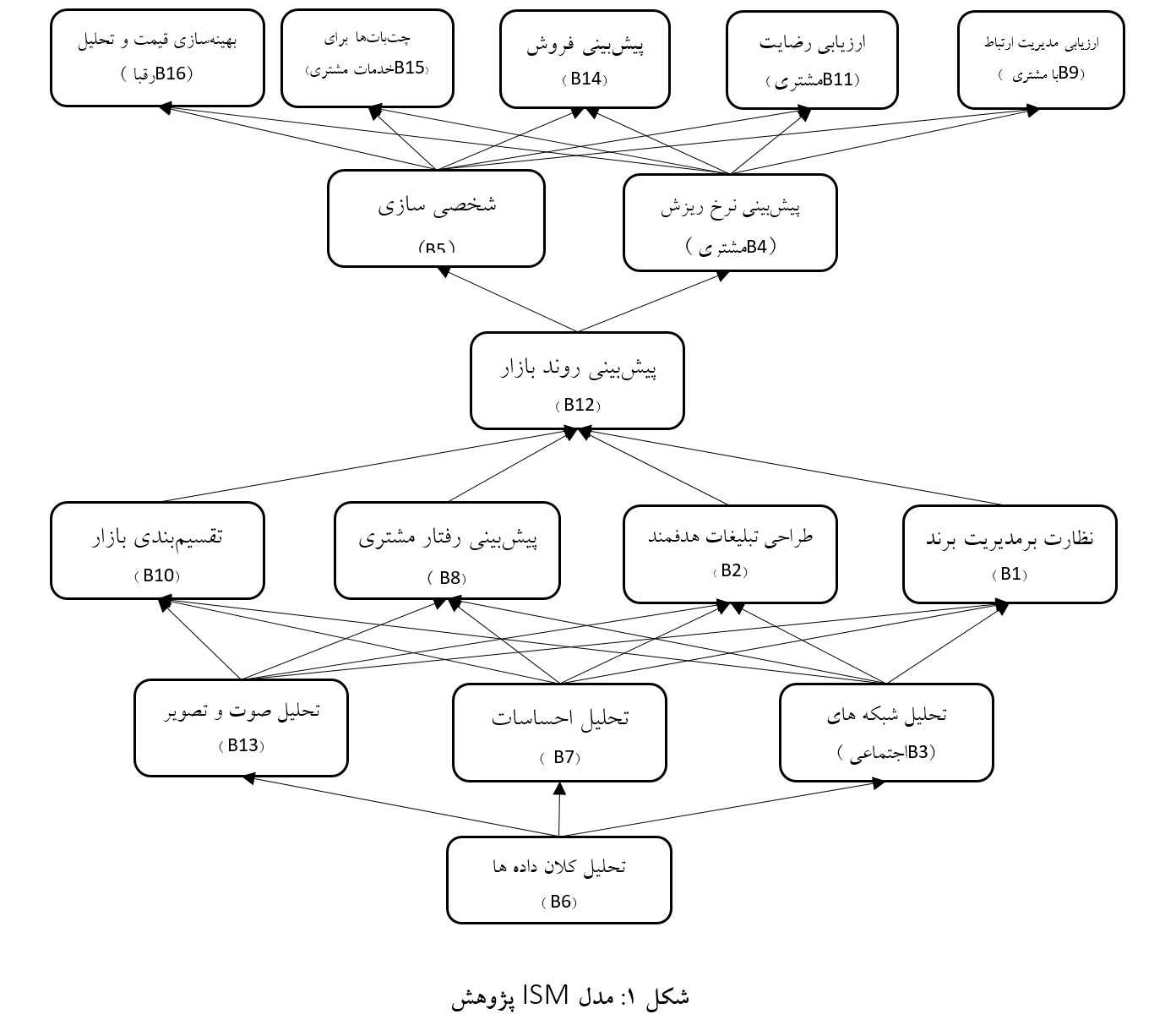

مدل توسعه سیستم هوش تجاری بر پایه اهداف استراتژیک و فرآیندهای سازمانی

هدف: این پژوهش با هدف ارائه مدلی نظام مند برای توسعه سیستم های هوش تجاری بر پایه اهداف استراتژیک و فرآیندهای سازمانی انجام شده است.

روش: این پژوهش از نوع توصیفی و جامعه آماری تحقیق را مدیران صنایع تولیدکننده پمپ و الکتروموتور تشکیل می دهد. پژوهش در سه مرحله برنامه ریزی و اجرا گردید، در مرحله نخست، اهداف استراتژیک سازمان از نظر امکان مشارکت در سیستم های هوش تجاری مورد ارزیابی قرار گرفتند. برای این ارزیابی، از چهار معیار اصلی برگرفته از پژوهش پیشین و از روش آماری آنتروپی شانون استفاده گردید و امکان مشارکت هر یک از اهداف در سیستم هوش تجاری، سنجیده شد. ابتدا وزن معیارها محاسبه و سپس امتیاز اهداف تعیین شد. اهداف با امتیاز بالاتر از 0.8 ، بهعنوان گزینههای مناسب برای مشارکت در طراحی (BI) انتخاب شدند. در مرحله دوم، ماتریسی طراحی شد تا تأثیر گروههای فرآیندی بر اهداف منتخب بررسی شود. در این مرحله بدلیل عدم قطعیت در دادهها، تحلیل اطلاعات با بهرهگیری از منطق فازی انجام گرفت. در نتیجه این تحلیل، فرآیندهای اثرگذار بر اهداف استراتژیک استخراج شدند. در مرحله سوم، شاخصهای کلیدی عملکرد (KPI) مرتبط با فرآیندها و اهداف منتخب شناسایی شدند. سپس با استفاده از تکنیک دلفی و طی پنج مرحله ، شاخصهای مؤثر انتخاب گردیدند.

یافته ها: یک چارچوب عملیاتی برای طراحی سیستم هوش تجاری همتراز با اهداف استراتژیک و فرآیندهای سازمانی ارائه گردید.

نتیجه گیری: با شناسایی اهداف قابل پشتیبانی توسط هوش تجاری و بهکارگیری متدولوژی پیشنهادی، امکان پایش تحقق اهداف استراتژیک فراهم شده به ارتقاء بهرهوری سازمان میانجامد.

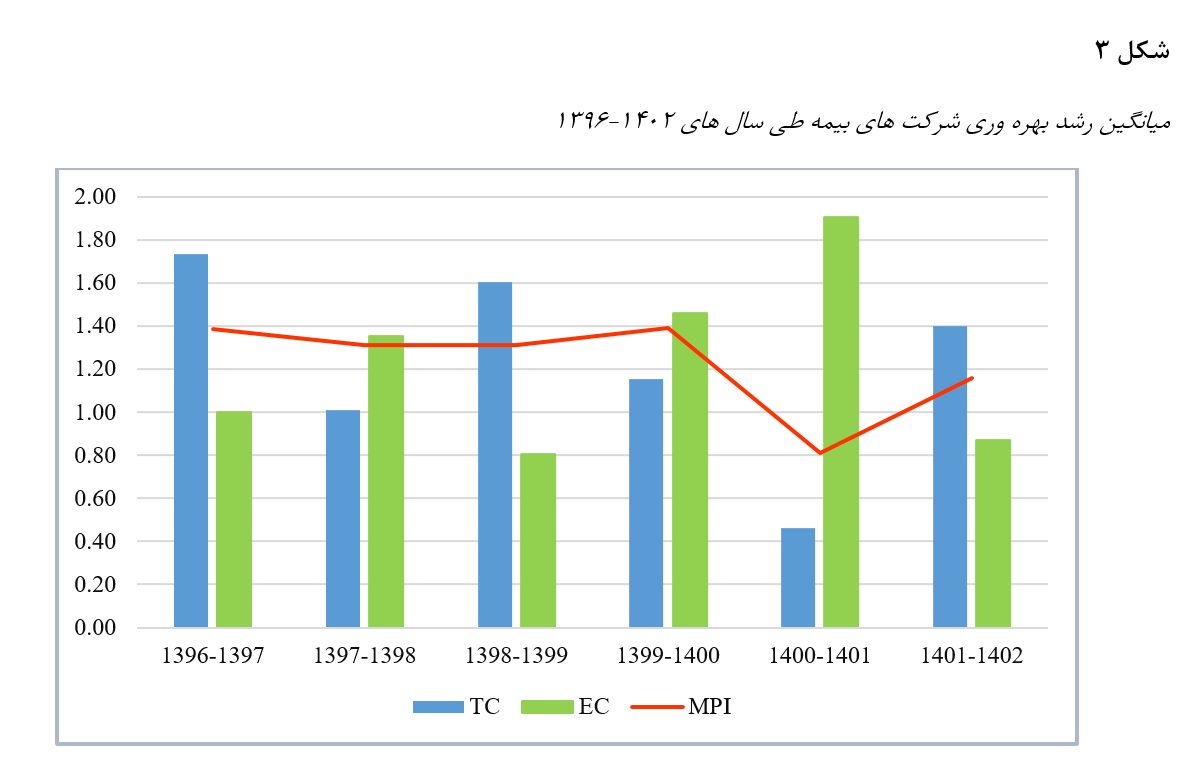

تحلیل کارایی و رشد بهرهوری صنعت بیمه ایران: رویکرد مبتنی بر تحلیل پوششی دادهها

صنعت بیمه یکی از ارکان حیاتی نظام مالی بهشمار میرود که با ایفای نقش در مدیریت ریسک، ارتقای تابآوری اقتصادی و تسهیل سرمایهگذاری، اهمیت فزایندهای در اقتصادهای نوظهور و پرتلاطم مانند ایران دارد. پژوهش حاضر با هدف ارزیابی عملکرد و تحلیل روند بهرهوری شرکتهای بیمه در ایران طی سالهای ۱۳۹۶ تا ۱۴۰۲، از رویکرد تحلیل پوششی دادهها (DEA) بر پایه مدل غیرشعاعی راسل و شاخص بهرهوری مالمکوئیست بهرهگیری کرده است. همچنین اثرگذاری متغیرهای زمینهای نظیر سرمایه، تعداد شعب و قدمت شرکتها بر کارایی با استفاده از مدل رگرسیون خطی مورد بررسی قرار گرفته است. برای این منظور از نرم افزار گمز استفاده شده است. یافتهها نشان میدهد که طی بازه مورد بررسی، صنعت بیمه ایران با روندی ناپایدار و عمدتاً نزولی در کارایی مواجه بوده است، بهویژه در سالهای بحرانی مانند 1400-۱۴۰۱ که افت چشمگیری در شاخصهای فناوری و بهرهوری مشاهده شده است. با این حال، در برخی سالها نشانههایی از بازیابی عملکرد و ظرفیت بالقوه برای رشد دیده میشود. نتایج همچنین حاکی از آن است که افزایش سرمایه بهتنهایی تضمینی برای ارتقاء کارایی نبوده و ساختارهای سنتی یا غیربهرهور مانع از استفاده بهینه از منابع شدهاند.

دربارهی مجله

درباره ما

مجله علم تصمیم گیری و سیستم های هوشمند یک مجله علمی پیشرو است که به پیشرفت زمینه های علم تصمیم گیری و سیستم های هوشمند با کمک ابزار تحقیق در عملیات (OR)، تحلیل پوششی داده ها (DEA) و مدل سازی ریاضی اختصاص دارد. ما مقالات اصیل و مروری در این زمینه را منتشر می کنیم که به درک نظری و عملی این رشته ها کمک می کند.

ماموریت ما

ماموریت ما این است که بستری را برای محققان و دست اندرکاران به منظور انتشار یافته های پیشرفته خود و تقویت همکاری در جامعه علمی فراهم کنیم. هدف ما ارتقای نوآوری، دقت و بکارگیری روشهای علمی برای حل مشکلات دنیای واقعی است.

محدوده پوشش

این مجله طیف گسترده ای از موضوعات را پوشش می دهد، از جمله:

تحلیل تصمیم گیری و بهینه سازی

یادگیری ماشین و هوش مصنوعی

مدیریت عملیات و تدارکات

تحلیل پوششی داده ها و ارزیابی عملکرد

مدل سازی و شبیه سازی ریاضی

برنامه های کاربردی در حوزه های مختلف، مانند مراقبت های بهداشتی، مالی و ...

مخاطب

این مجله برای محققان، دانشگاهیان، متخصصان صنعت و سیاست گذاران علاقه مند به آخرین پیشرفت ها و کاربردهای علم تصمیم گیری و سیستم های هوشمند مورد مطالعه قرار می گیرد.

فرآیند ویرایش

مجله برای اطمینان از کیفیت و اصالت همه مقالات منتشر شده، از یک فرآیند بررسی دقیق پیروی می کند. هر نسخه خطی توسط متخصصان این حوزه مورد بررسی قرار می گیرد. هیئت تحریریه متشکل از اساتید مشهور و پیشروان صنعت است که راهنمایی و پشتیبانی از اهداف مجله را بر عهده دارند.

مجله ما از مقالات ارسالی محققان در سراسر جهان استقبال می کند و از شما دعوت می کنیم که کار خود را در علوم تصمیم گیری و سیستم های هوشمند در مجله ما منتشر کنید.

شماره کنونی